Calculate depreciation of laptop

You can calculate expenses using the IRSs standard mileage rate 585 cents per mile for the first half of 2022 and 625 cents per mile for the last half of 2022. And as above suggest it will resolve your super question which there is no harm checking with HR.

How To Handle Tangible Fixed Assets Changing Tides

Customers are created as non-taxable when synchronizing taxable Shopify Sales Orders for new customers in.

. Businesses can take advantage of bonus depreciation to deduct 100 of the cost of machinery equipment computers appliances and furniture. For example if you have to work out the original price of a laptop that is being sold at 25 off. If you use your laptop 100 for work over the life of its depreciation 2-3 years based on ato website you will get that 600 back in tax deductions plus whatever other expenses you claim.

The new rules allow for 100 bonus expensing of assets that are new or used. At the end of the 2nd year value of Macbook will be 160000 32000 128000. For qualified assets that were purchased new before September 28 2017 the old rules of 50 bonus depreciation still apply.

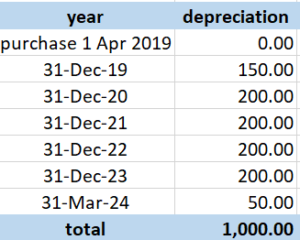

The number of years over which you depreciate something is determined by its useful life eg a laptop is useful for about five years. If you purchase a 15-inch laptop for 1500 and submit a request for recoverable depreciation you will be reimbursed 400. If the cost of the computer was 1000 for example then 200 a year can be included in the companys total depreciation amount each year for five years.

There are 4 pre-conditions on the under-300 full claim allowance. The cost is less than 300. Special rules for business vehicles can deliver healthy tax savings.

Second year we will calculate the depreciation on 160000 20 which will be 32000. If you purchased a new vehicle during the tax year the IRS limits write-offs for passenger vehicles. Tax Audit Limit in the case of a Business.

To calculate your businesss total assets you first need to know what assets you have. In the first year if you dont claim bonus depreciation the maximum depreciation deduction is 10100. To calculate SYD depreciation you add up the digits in the assets useful.

It pays to learn the nuances of mileage deductions buying versus leasing and depreciation of vehicles. Theres more than one method to calculate depreciation. Current price is 100 - 25.

Track the physical condition and financial status of your companys equipment. All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. For example you are saving money to buy a camera or a laptop.

Returns the depreciation of an asset for a specified period by using the fixed-declining balance method. For tax depreciation different assets are sorted into different classes and each class has its own useful life. What is the Tax audit limit under section 44AB.

Straight-line depreciation allows an equal portion of the laptops cost to be claimed in each year over the total depreciation period. Record model and serial numbers purchase information and operating costs and this accessible template will calculate depreciation. Returns the discount rate for a security.

In order to report information as required by Income Tax Act like Tax Depreciation etc. Unable to calculate Low Level Code but can use assemblymulti-level assembly with an Essentials license in the United States version. Depreciation schedule as per Companies Act during the useful life of asset laptop.

The percentage of bonus depreciation phases down in the year. Returns the depreciation of an asset for a specified period by using the double-declining balance method or some other method that you specify. Note the depreciation of the computer would be an expense but not the computer itself this may seem like semantics but assets and expenses are separate and distinct categories.

Depreciation rate for laptop is 6316. Assets are any resources of financial value to a business. In accounting terminology it is called provision for camera or laptop.

Now that we know the depreciation rate we can calculate the depreciation amount during the useful life of the asset laptop Step 4. Where the cost is more than 300 then the depreciation formula must be used to calculate the percentage tax deductible amount. The costs associated with making the slippers fall under cost of goods sold while the costs of shipping them to the customer is a selling expense.

It means an assessee needs to be audited under Sec 44AB if his annual gross turnoverreceipts in business exceeds Rs. Work out the current price as a percentage of the original price 100. In the previous example we determined the ACV of your 13-inch laptop was 600 and the cost of a similar laptop is 1000.

Start by listing the value of any current assets assets that can easily be converted to cash like cash money owed to.

Depreciation Rate Formula Examples How To Calculate

What Is Straight Line Depreciation Yu Online

How To Calculate Depreciation Legalzoom

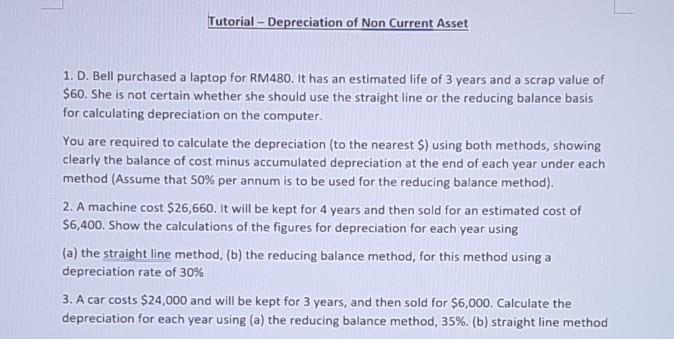

Solved Tutorial Depreciation Of Non Current Asset 1 D Chegg Com

Depreciating Capital Costs Wikieducator

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Rate Formula Examples How To Calculate

Working With Excel S Choose Function K2 Enterprises

How To Calculate Book Value 13 Steps With Pictures Wikihow

Depreciation Formula Calculate Depreciation Expense

Projectmanagement Com What Is Depreciation

Salvage Value Formula Calculator Excel Template

How To Calculate Depreciation Know Your Assets Real Value

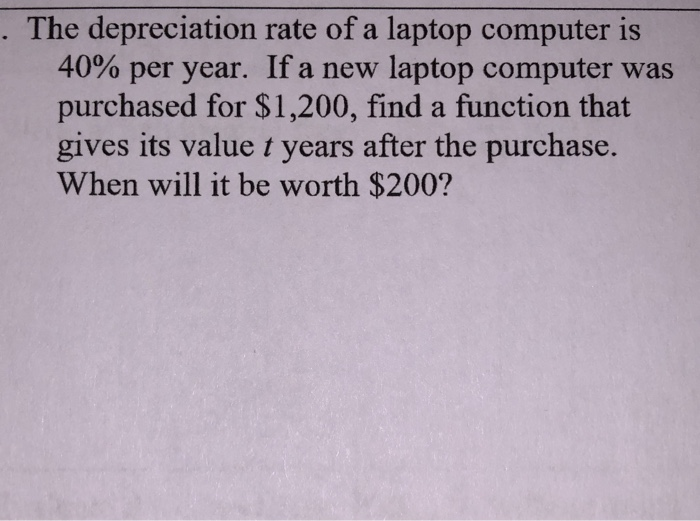

Solved The Depreciation Rate Of A Laptop Computer Is 40 Chegg Com

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Calculator